Tax In Georgia 2024

Tax In Georgia 2024. If you make $70,000 a year living in georgia you will be taxed $11,047. For the 2023 tax year, the income tax in georgia on taxable income was a high of 5.75% (on over $7,000 for single filers and $10,000 for joint filers).

Georgia’s 2024 income tax ranges from 1% to 5.75%. The tax rate(s) that apply to you depend on taxable income and filing status.

However, Beginning In 2024, The State Income.

Paying your estimated tax electronically is the fastest method.

Georgia’s Income Tax Landscape Has Already Undergone Recent Changes.

The georgia house is passing bills to cut state income and local property taxes, backing plans by gov.

Under The Bill The Corporate Income Tax Rate Would Keep Falling Along With The Personal Income Tax Rate Until Reaching 4.99%.

Images References :

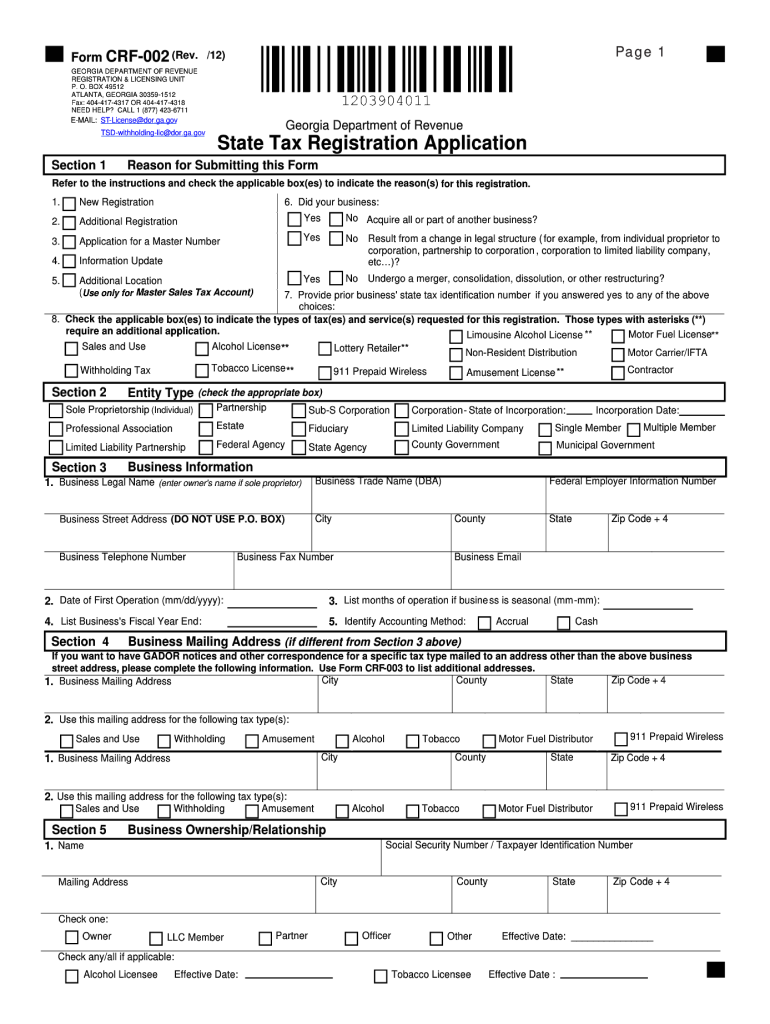

Source: www.dochub.com

Source: www.dochub.com

state tax form Fill out & sign online DocHub, 24, 2024 at 3:33 pm pst. For 2023 (tax returns filed in 2024), georgia has six state income tax rates:

Source: www.dochub.com

Source: www.dochub.com

Form 500 Fill out & sign online DocHub, However, beginning in 2024, the state income. 1%, 2%, 3%, 4%, 5% and 5.75%.

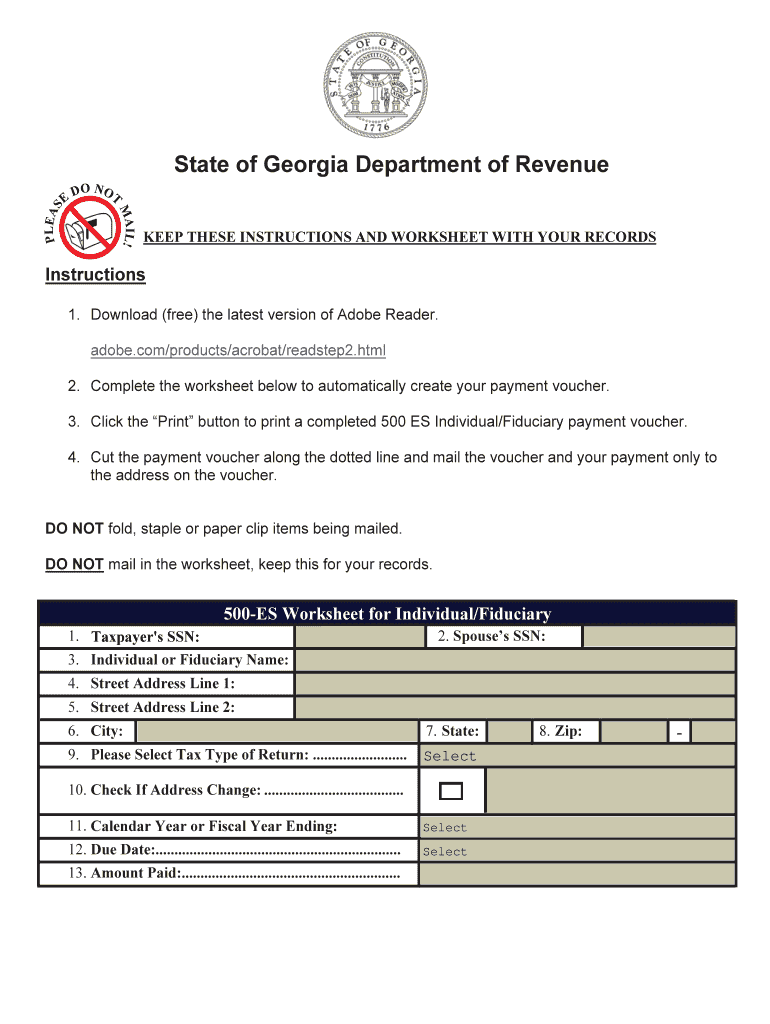

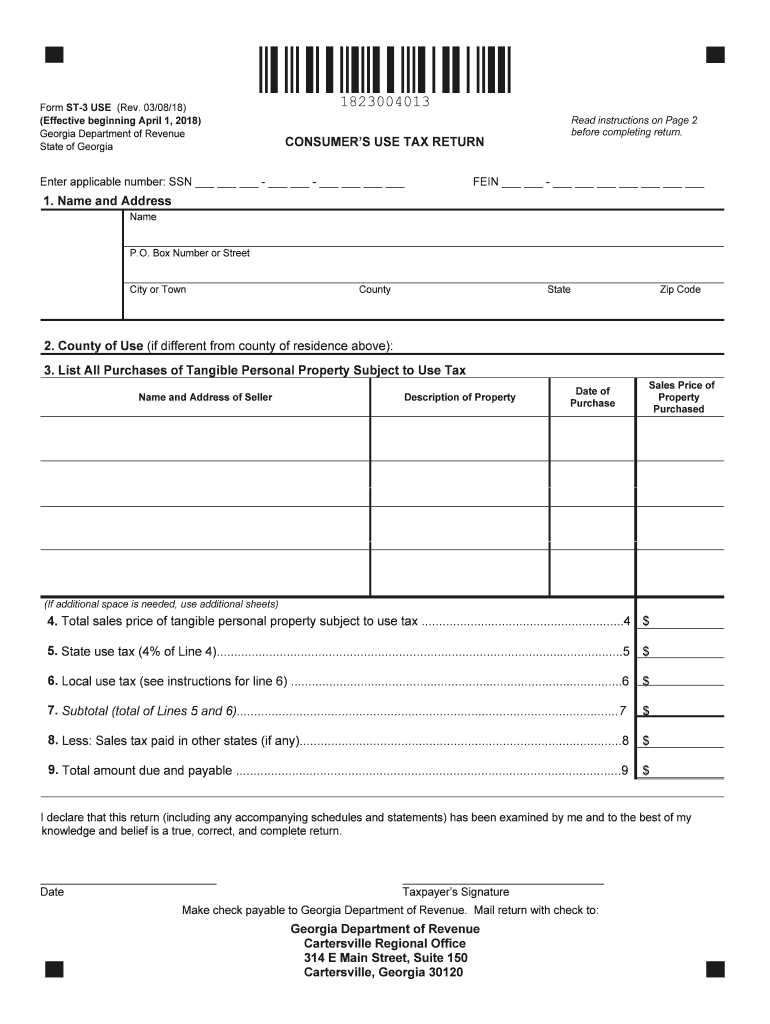

Source: www.signnow.com

Source: www.signnow.com

Estimated Tax S 20192024 Form Fill Out and Sign Printable, Paying your estimated tax electronically is the fastest method. The tax rate(s) that apply to you depend on taxable income and filing status.

Source: www.signnow.com

Source: www.signnow.com

State Tax PDF 20182024 Form Fill Out and Sign Printable PDF, Georgia’s income tax landscape has already undergone recent changes. Check your refund online (does not require a login) sign up for georgia tax center (gtc) account.

Source: itep.org

Source: itep.org

How the House Tax Proposal Would Affect Residents’ Federal, Assuming delays are not required, following is the personal. 1%, 2%, 3%, 4%, 5% and 5.75%.

Source: serious-mumma.blogspot.com

Source: serious-mumma.blogspot.com

Ga State Tax Refund Serious Mumma, Paying your estimated tax electronically is the fastest method. Check your refund online (does not require a login) sign up for georgia tax center (gtc) account.

Source: gbpi.org

Source: gbpi.org

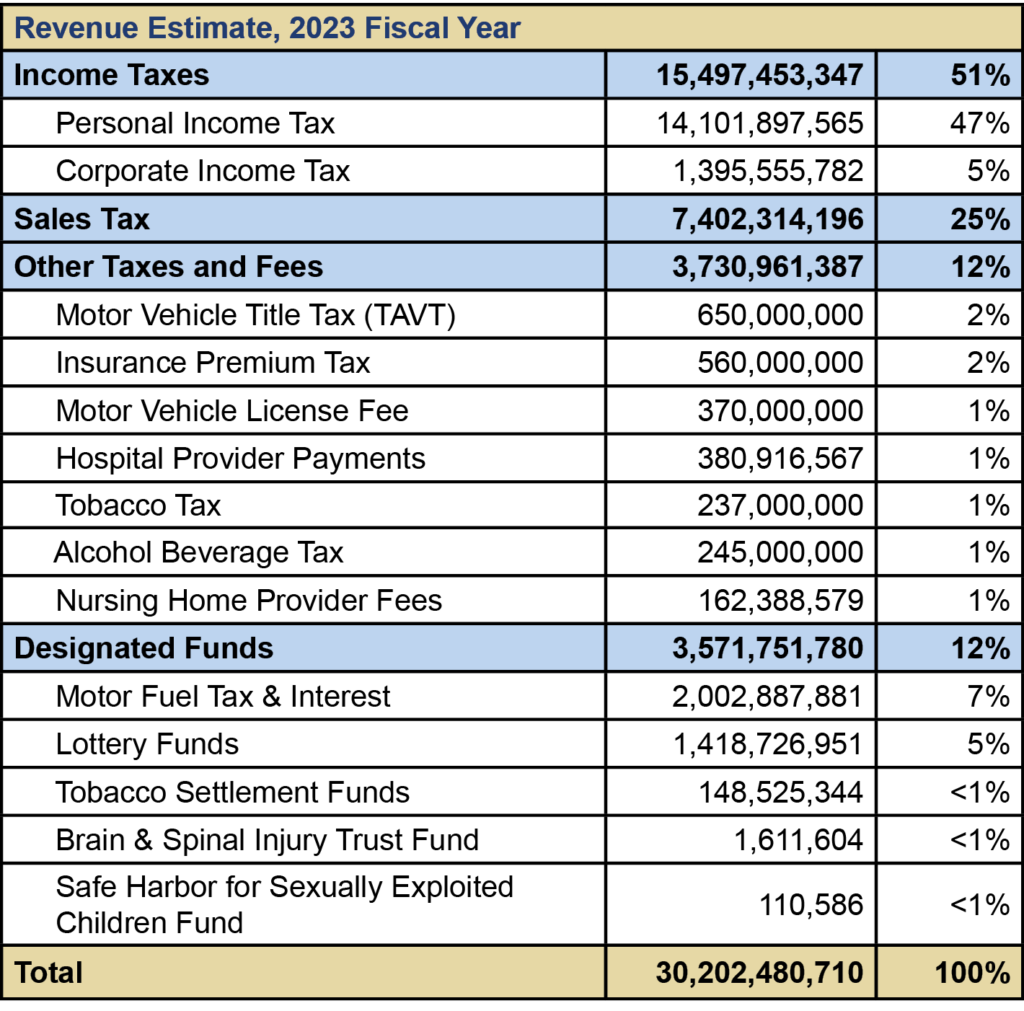

Revenue Primer for State Fiscal Year 2023 Budget and, These rate reductions can be delayed by one year for each year that certain budget requirements are not met. Gtc provides online access and can send.

Source: taxfoundation.org

Source: taxfoundation.org

2023 State Tax Rates and Brackets Tax Foundation, 24, 2024 at 3:33 pm pst. Georgia's 2024 income tax ranges from 1% to 5.75%.

Source: gbpi.org

Source: gbpi.org

Revenue Primer for State Fiscal Year 2022 Budget and, Check your refund online (does not require a login) sign up for georgia tax center (gtc) account. At the start of the year, georgia transitioned to a flat tax.

Source: gbpi.org

Source: gbpi.org

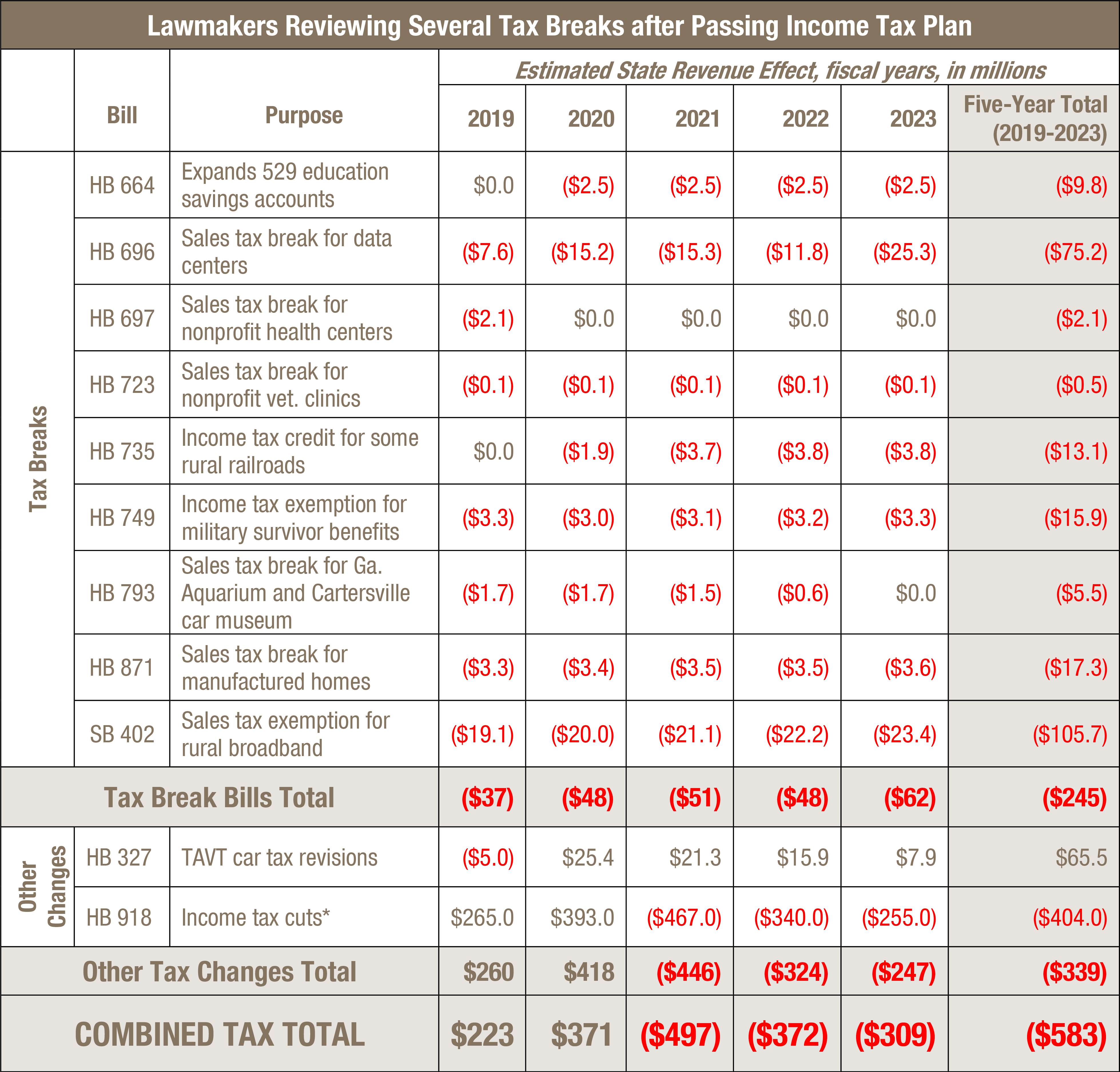

Lawmakers Approve Major Tax Plan, Still Reviewing Several Tax Breaks, Assuming delays are not required, following is the personal. Georgia income tax rate 2024.

Georgia's 2024 Income Tax Ranges From 1% To 5.75%.

Georgia’s income tax landscape has already undergone recent changes.

For Tax Year 2024, The Standard.

Gtc provides online access and can send.