Corrected 1099 Deadline 2024

Corrected 1099 Deadline 2024. Say you were paid a consulting fee of $30,000 in 2023, but the 1099 you receive in january 2024 is for ten times that, $300,000? 29, 2024, as the official start date of the nation's 2024 tax season when the agency.

Paper filing postmarked by february 28, 2024; When are 1099 forms due?

January 22, 2024 12:48 Pm.

The irs allows for the correction of 1099 forms even after the initial filing deadline has passed.

Paper Filing Postmarked By February 28, 2024;

In 2024 (for tax year 2023), a new mandate began that required any organization filing ten or more of any combination of varieties of form 1099 to file these forms electronically.

29, 2024 —You've Likely Received Several Tax Reporting Forms Already, Or.

Images References :

Source: www.executivechronicles.com

Source: www.executivechronicles.com

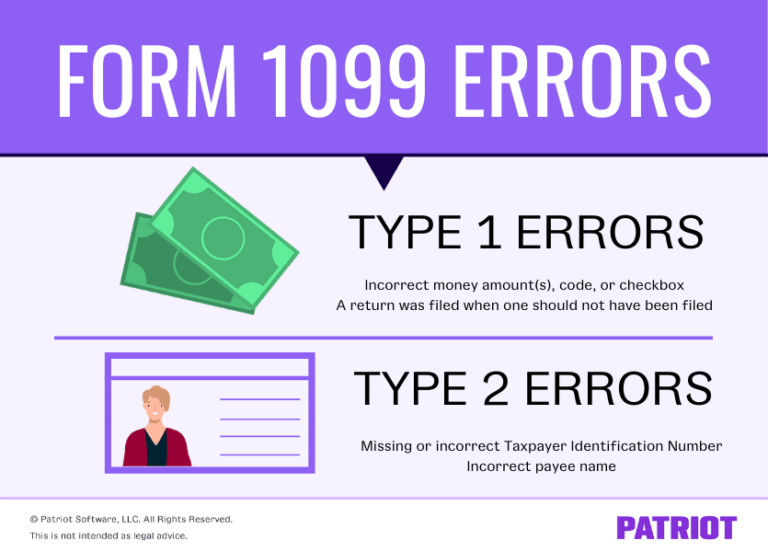

Corrected 1099 Common Mistakes and How to File Online Read Now!, Thanks for joining the community, vhoaboard. Say you were paid a consulting fee of $30,000 in 2023, but the 1099 you receive in january 2024 is for ten times that, $300,000?

Source: www.taxbandits.com

Source: www.taxbandits.com

EFile 1099 Correction form How to correct 1099 Form Online, The deadline for distributing 1099s to vendors is jan. The deadline for filing 1099 forms depends on the type of form you are filing.

Source: merlinewterri.pages.dev

Source: merlinewterri.pages.dev

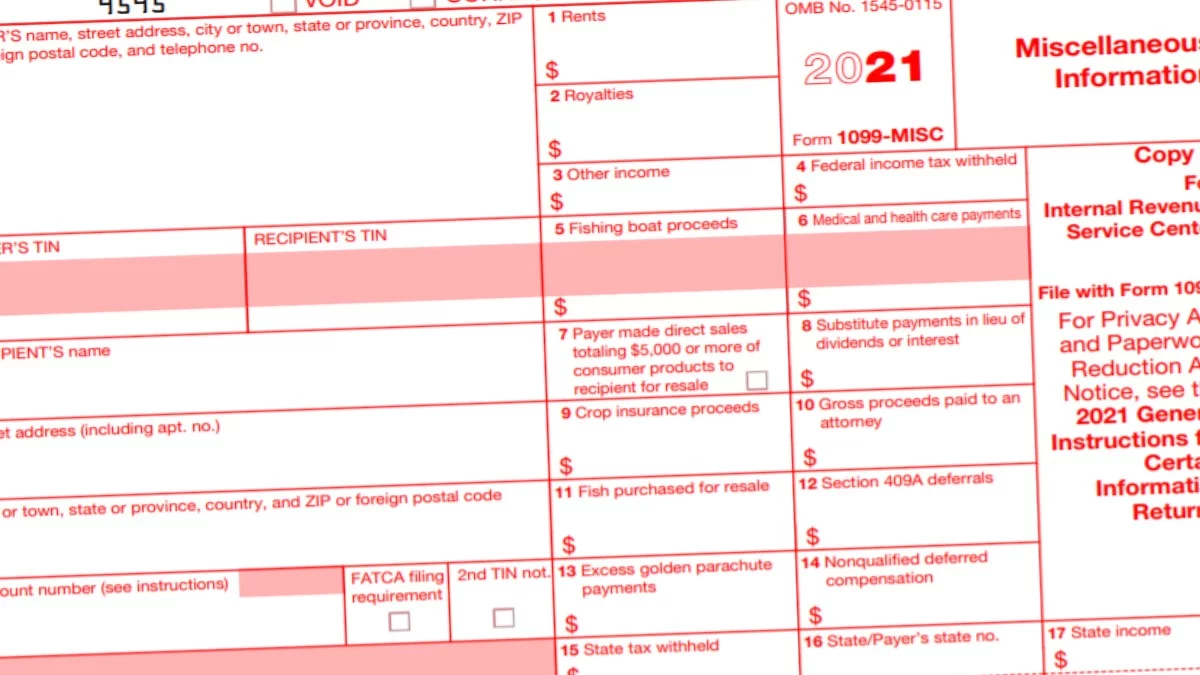

1099s 2024 Form Wini Ofilia, Gail cole feb 19, 2024. If you use paper 1099s, you must then file another information return, form 1096, to transmit the.

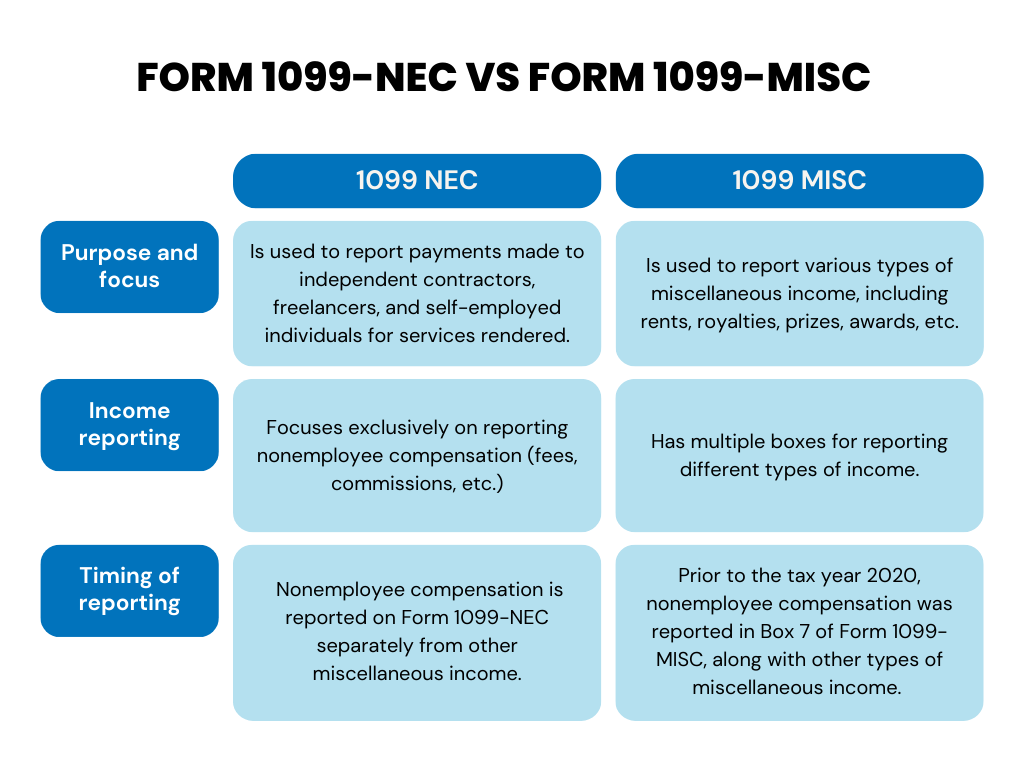

Forms 1099 NEC vs 1099 MISC (Differences for 2023) Tipalti, The best way to avoid issues with. The deadline for filing 1099 forms depends on the type of form you are filing.

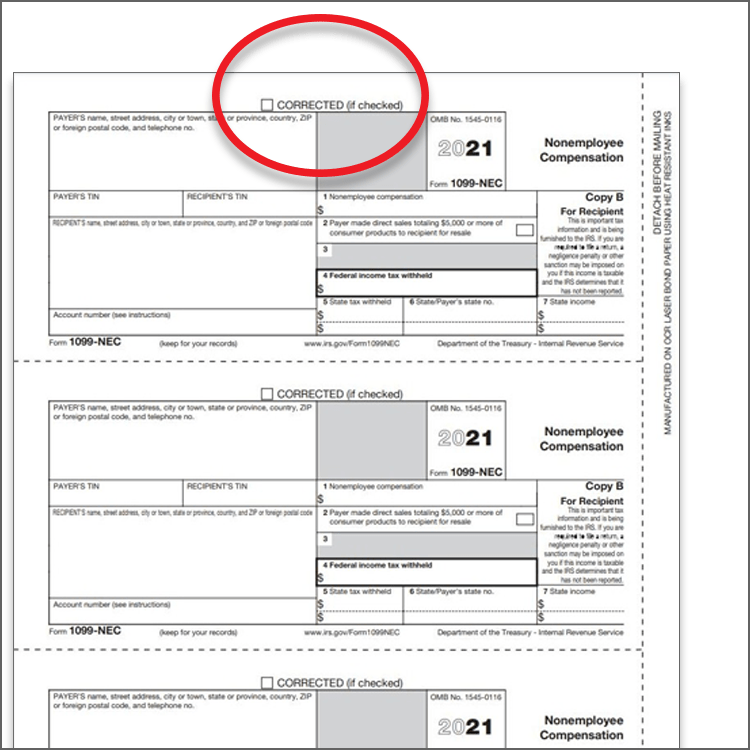

Tax Form 1099MISC Instructions How to Fill It Out Tipalti, You must use a regular copy of form 1099 (either nec or misc) and mark the box next to “corrected” at the top. The deadline for filing 1099 forms depends on the type of form you are filing.

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

Corrected 1099 Issuing Corrected Forms 1099MISC and 1099NEC, You must use a regular copy of form 1099 (either nec or misc) and mark the box next to “corrected” at the top. January 22, 2024 12:48 pm.

Source: mungfali.com

Source: mungfali.com

1099 Cheat Sheet, The deadline for filing 1099 forms depends on the type of form you are filing. Paper filing postmarked by february 28, 2024;

Source: printableformsfree.com

Source: printableformsfree.com

1099 Correction Form 2023 Printable Forms Free Online, For tax year 2022, the filing deadline for brokers to submit 1099 files to the irs is march 31, but some brokers will file for an extension. For the most part, the rest of the 1099 forms are due to the irs by february 28, 2024, if paper filing or march 31, 2024, if electronically filing.

Source: synder.com

Source: synder.com

How To File 1099 NEC Guide On Form 1099NEC Reporting, When dealing with 1099 forms, it is essential to be aware of the deadlines and dates. January 22, 2024 12:48 pm.

Source: promo.pearlriverresort.com

Source: promo.pearlriverresort.com

1099 Misc Printable Template Free Printable World Holiday, For tax year 2022, the filing deadline for brokers to submit 1099 files to the irs is march 31, but some brokers will file for an extension. The above dates are listed on the irs fire page as of the publication.

Send Corrected Forms 1099 To The Irs, Contractor Or Vendor, And State Agencies (If.

Washington — the internal revenue service today announced monday, jan.

Thanks For Joining The Community, Vhoaboard.

With tax season just getting started— the season officially opens on jan.